Modest GBP bid following UK inflation beat

Earlier this morning, the Office for National Statistics (ONS) published the UK inflation figures for April, and, as widely anticipated, they were higher than in March. The increase in inflation is unlikely to have surprised market participants; ‘awful April’ was widely telegraphed, supported by several price increases, including a 6.4% rise in energy bills, higher National Insurance contributions, and an increase in the National Living Wage.

Headline consumer price inflation rose by 3.5% year on year (YY), up from March’s 2.6%, with month-on-month (MM) data climbing to 1.2% from 0.3%. You will likely remember that the Bank of England’s (BoE) latest forecasts suggest that inflation is expected to peak at 3.7% this year before eventually returning to the bank’s inflation target of 2.0%.

Core inflation rose by 3.8% YY, up from 3.6%, and MM data jumped by 1.4% (up from 0.5%). On the services front, a print closely watched by BoE policymakers, MM and YY numbers increased by 2.2% and 5.4%, respectively.

As you can see, all measures reported hotter-than-expected data, resulting in an immediate – albeit short-lived – rise in the British pound (GBP) against its G10 peers. Compared to the US dollar (USD), the GBP surged to levels not seen since early 2022; we also observed a modest increase in UK gilt yields upon market opening.

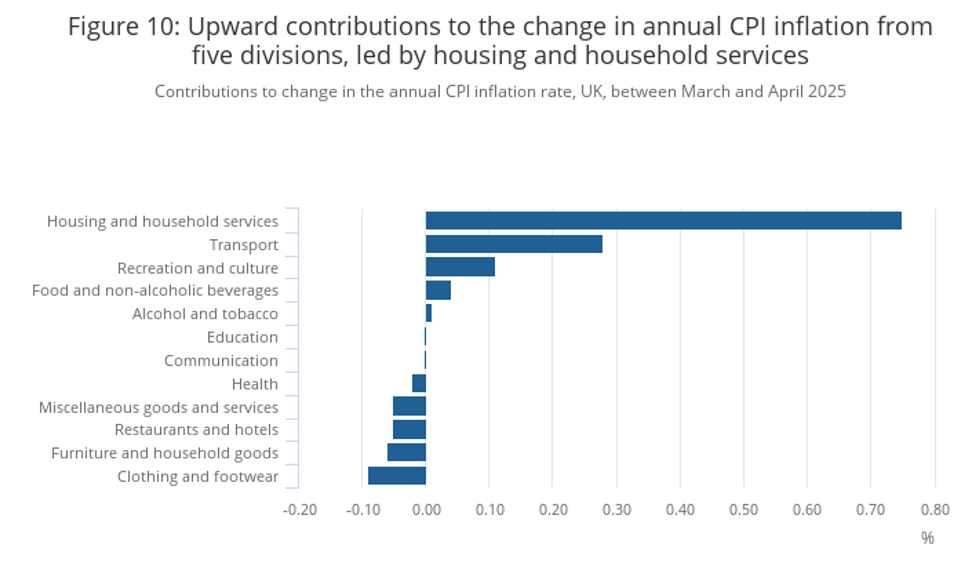

According to the ONS report (see below), the most significant contributors driving the unexpected upside surprise were from ‘housing and household services’ and ‘transport’. This should not raise too many eyebrows, given the rising household bills. Offsetting this, the largest downward contributions came from ‘clothing and footwear’.

Source: Consumer price inflation from the Office for National Statistics

With headline YY inflation now at its highest level since the beginning of 2024, core YY inflation at its highest since April 2024, and YY services inflation at its peak since mid-2024, today’s stronger-than-expected data is not pleasant reading at the BoE or the UK economy. This is especially true for service inflation; given that the UK is a service-led economy, this will likely dissuade the central bank from cutting rates as long as this measure remains high.

However, with growth and jobs data likely to cool, inflation is unlikely to remain elevated and could pave the way for further easing. According to market pricing, investors have scaled back their rate-cut expectations for later in the year, with a 50/50 chance of a reduction in August, down from approximately 60% before the data release. Currently, a total of 37 basis points (bps) of easing is priced in until the end of the year, indicating just over one rate cut and not much difference from the 40 bps worth of cuts priced in before the release. It is also worth bearing in mind that BoE’s chief economist, Huw Pill, recently voiced that he feels rates have eased too quickly and opposed the central bank’s recent 25 bp reduction earlier this month.

It is essential to consider the current state of the UK economy. On one side of the fence, we have rising price pressures, while on the other side, weak growth, thus placing the BoE and the government in a challenging position on increasing stagflation fears. Knowing this, and recognising that we have heavyweight long-term resistance overhead on the GBP/USD at US$1.3483 (see the monthly chart below), I remain biased towards GBP weakness for the time being.

Charts created using TradingView

Written by FP Markets Chief Market Analyst Aaron Hill

DISCLAIMER:

The information contained in this material is intended for general advice only. It does not take into account your investment objectives, financial situation or particular needs. FP Markets has made every effort to ensure the accuracy of the information as at the date of publication. FP Markets does not give any warranty or representation as to the material. Examples included in this material are for illustrative purposes only. To the extent permitted by law, FP Markets and its employees shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided in or omitted from this material. Features of the FP Markets products including applicable fees and charges are outlined in the Product Disclosure Statements available from FP Markets website, www.fpmarkets.com and should be considered before deciding to deal in those products. Derivatives can be risky; losses can exceed your initial payment. FP Markets recommends that you seek independent advice. First Prudential Markets Pty Ltd trading as FP Markets ABN 16 112 600 281, Australian Financial Services License Number 286354.