Top 5 AI Stocks to Watch in 2026

Artificial Intelligence (AI) is far more than just a trend. AI drives real growth in cloud computing, enterprise software, and consumer technology.

For investors, this means exciting stock market opportunities in tech companies leading the AI revolution. In this article, we highlight five AI stocks to watch closely in 2026 and what could make them stand out.

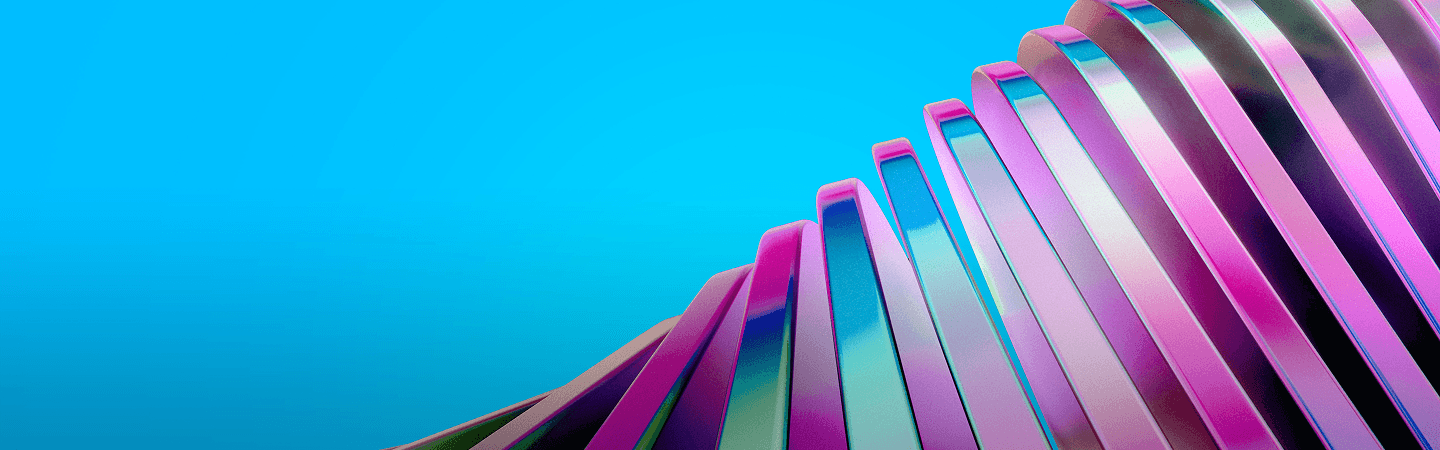

Nvidia (NVDA)

Nvidia remains the dominant supplier of graphics processing units (GPUs), which are widely used in data centres and cloud infrastructure to train and run the majority of modern AI models worldwide. According to company data, revenue surged by 62% year-on-year in the third quarter of 2025 (Q3 25), reaching US$57 billion. Led by CEO Jensen Huang, Nvidia was the first company to reach the US$5 trillion mark in terms of market capitalisation in October 2025.

Looking ahead, Nvidia expects an additional revenue stream from the Chinese market, as the US administration allowed the company to sell H200 chips to ‘approved customers’. When asked by journalists, Huang said that Nvidia has US$500 billion in bookings for advanced chips scheduled through 2026. Company executives have announced the roll out of the Nemotron-3 AI open-source models for 2026. Wall Street analysts suggest that Nvidia’s new models will compete closely with solutions from DeepSeek and Alibaba.

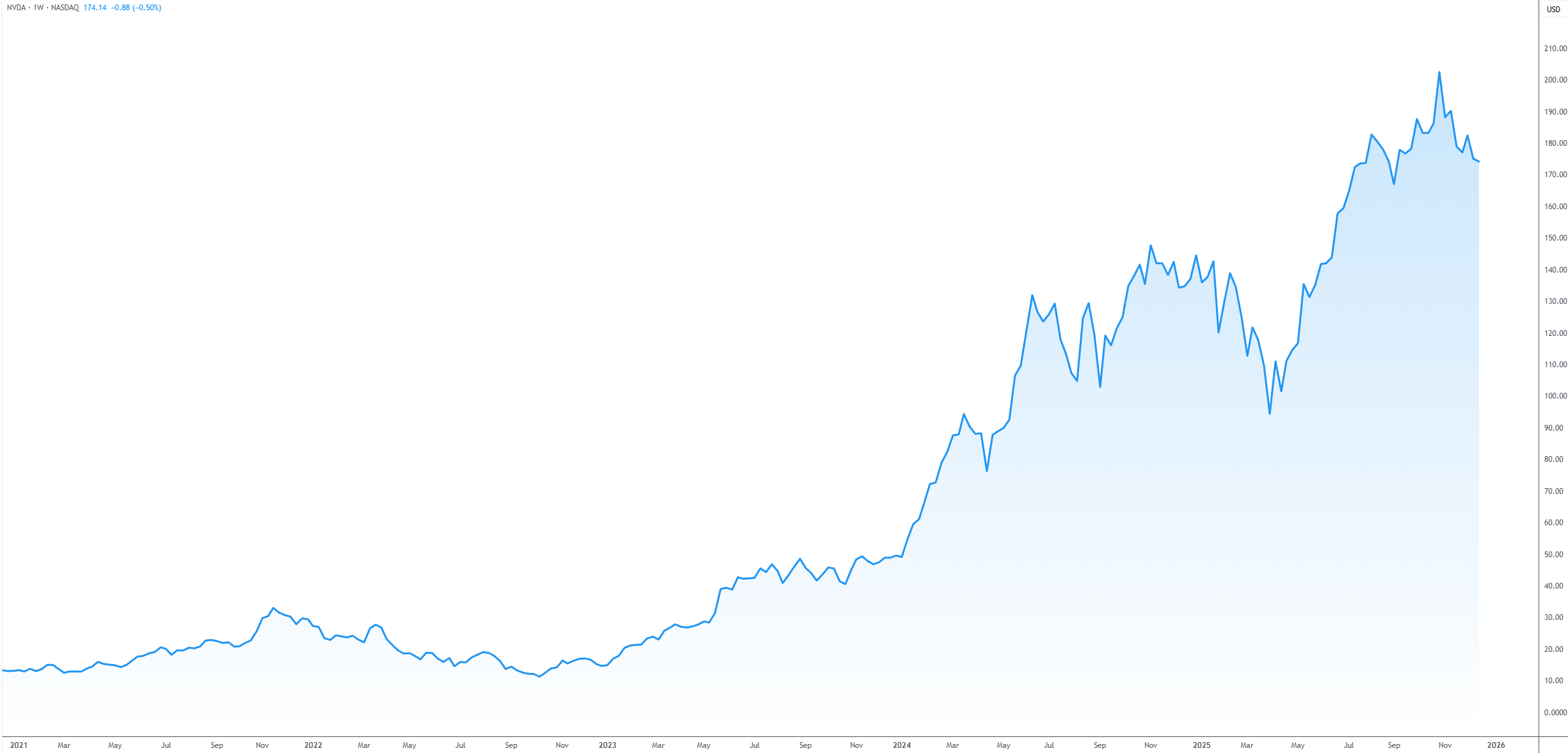

Microsoft (MSFT)

Investors view Microsoft as one of the most strategically positioned AI vendors in the market. Microsoft’s stock managed to outpace the S&P 500 return in 2025, extending a multi-year streak of strong performance. Company analysts forecast that Microsoft will be well-placed to achieve double-digit revenue and operating income growth in 2026.

The company has announced plans to invest US$23 billion in AI infrastructure across India and Canada to strengthen its presence in the cloud-computing market. Microsoft also expects the world’s most powerful AI datacentre to begin operations in Wisconsin during the first months of 2026, at an estimated cost of more than US$3.3 billion. The company plans to integrate AI across services such as Office and GitHub, while scaling Azure’s AI platform to support the deployment and integration of AI systems into business workflows.

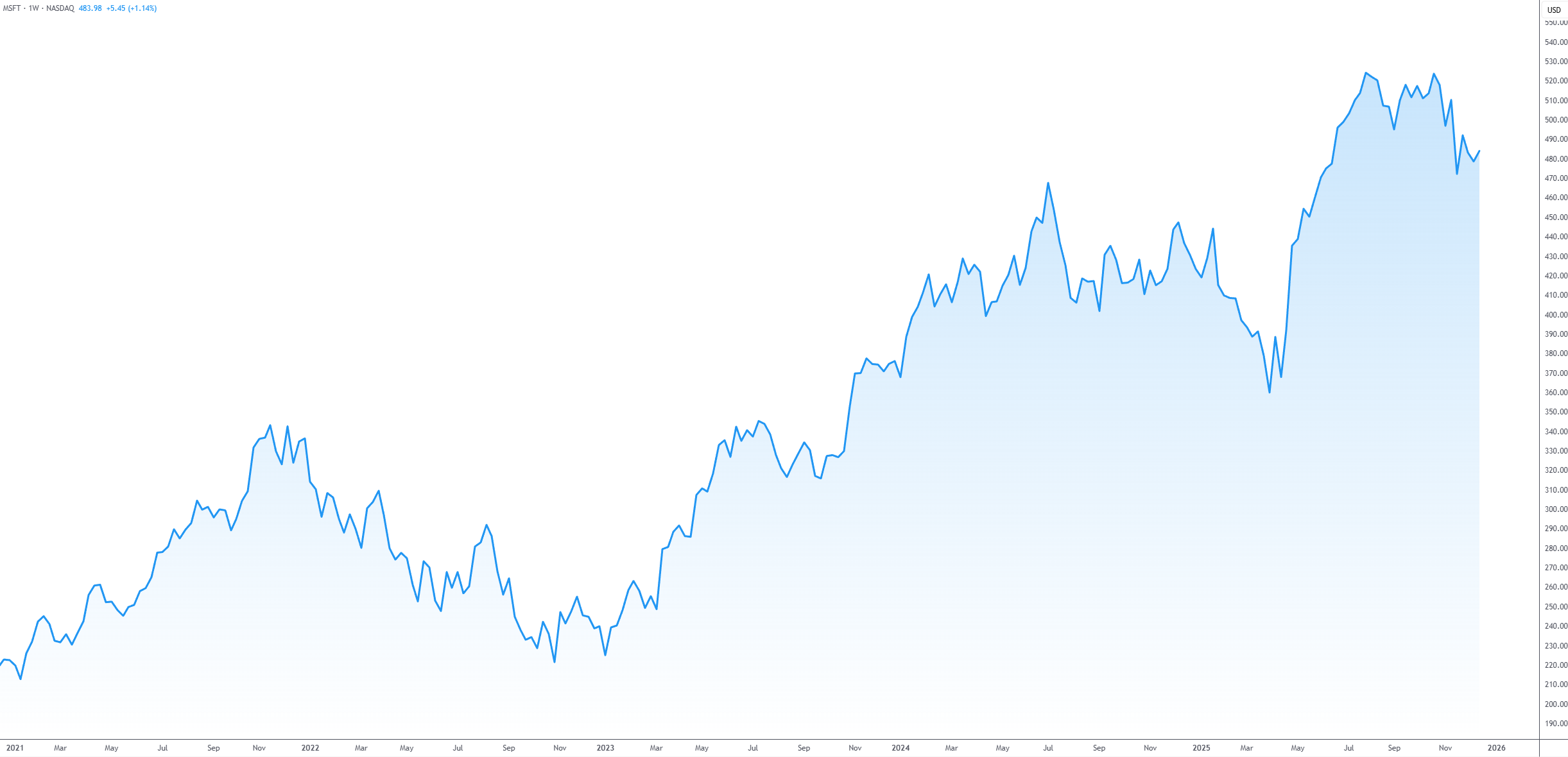

Amazon (AMZN)

2025 was not a particularly favourable year for Amazon, as its share price rose by 4% during the year and significantly underperformed the S&P 500. Market analysts, however, note that increased investment plans could trigger the company’s growth reacceleration, suggesting that even a 30% increase in share price in 2026 could be in the cards.

Amazon plans an investment of up to US$50 billion to boost the Amazon Web Services (AWS) AI capabilities. The project includes building and deploying a high performance computing network for use by US government agencies. According to media reports, Amazon has entered negotiations to invest around US$10 billion in OpenAI, exploring a partnership that could involve providing an enterprise version of ChatGPT in exchange for usage rights to Amazon’s Trainium chips.

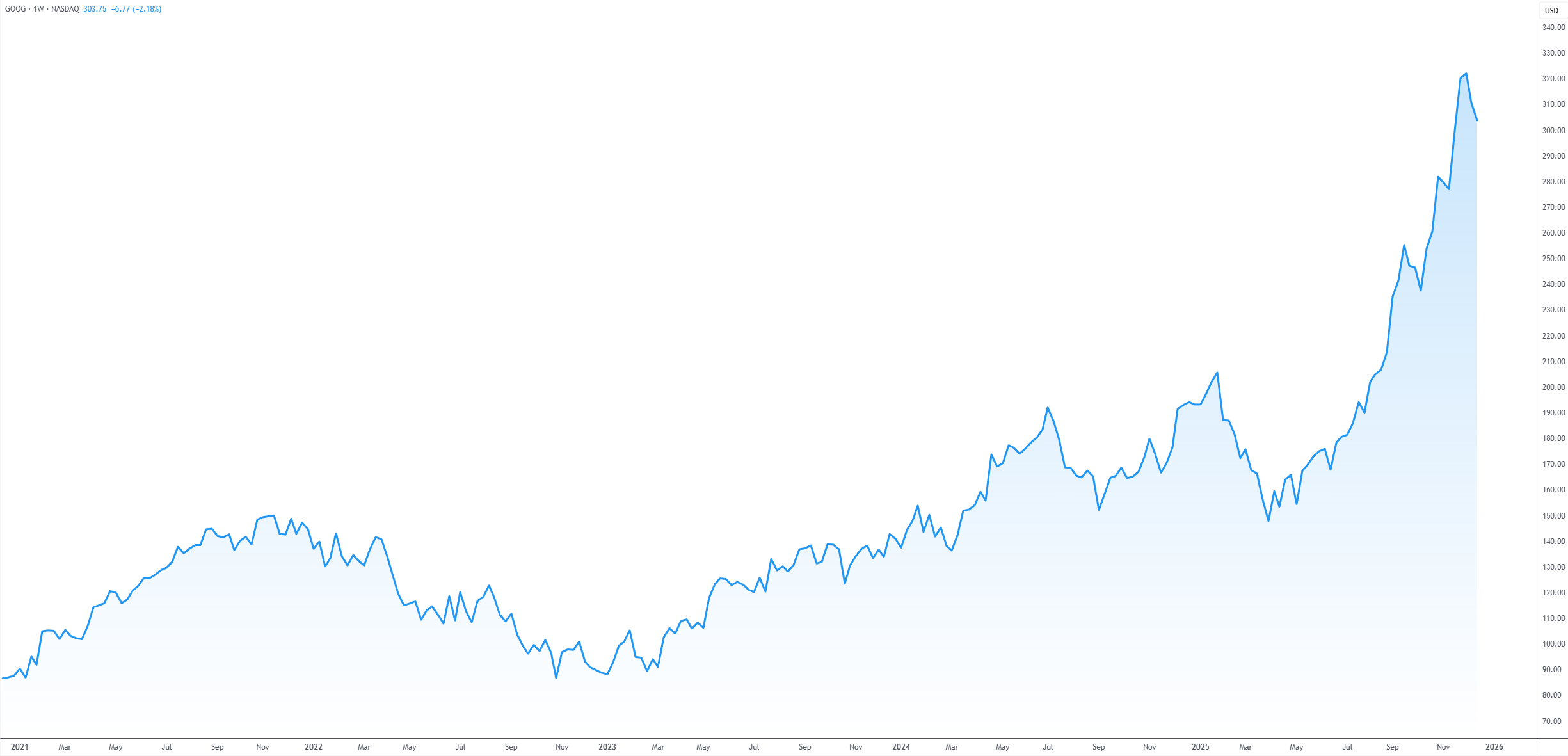

Alphabet (GOOG)

Alphabet’s share price increased by 65% in 2025, placing it among the top-performing tech stocks when compared to the Magnificent Seven group’s rival companies. Reports suggest that Google’s generative AI, Gemini 3, has surpassed ChatGPT in benchmark tests, leading OpenAI’s Sam Altman to call for a ‘code red’ response. It is estimated that Gemini 3 has more than 650 million monthly users.

Media reports suggested that Alphabet plans to introduce ads within Gemini in 2026 with some analysts questioning the impact of such a move. On capital expenditure, company executives stressed that they expect a significant increase compared with the previous year that could potentially exceed US$91 billion. Google has also announced a new €5.5 billion investment programme focused on AI and Cloud infrastructure in Germany.

Meta Platforms (META)

Meta’s share value rose around 11% in 2025. Revenue rose 26% on a yearly basis, in Q3 25, exceeding analysts’ expectations. CEO Mark Zuckerberg suggested that AI-powered recommendations on Facebook and Threads made users spend more time on the apps, increasing ad revenue.

Projections indicating that capex in 2026 could rise above US$100 billion have spurred discussions about potential financial pressures, as Meta may need to redirect a substantial portion of its resources to developing new AI-focussed data centers. A new multi-gigawatt data centre, named Prometheus, is expected to become operational in the US next year, while company recruiters hire highly-qualified staff to help Meta’s progress in AI development. Media reports suggest that Meta has tested its first AI training chip, aiming to reduce its reliance on rival companies.

Charts created using TradingView

Written by the FP Markets Research Team